Are you planning on pursuing a higher education but worried about the costs? Look no further than federal student aid. This type of financial assistance is available to help students cover the expenses of attending college or university. It includes grants, loans, and work-study programs sponsored by the federal government. In this guide, we will explore the different types of federal student aid, eligibility requirements, application process, and frequently asked questions.

DANH MỤC BÀI VIẾT

Types of Federal Student Aid

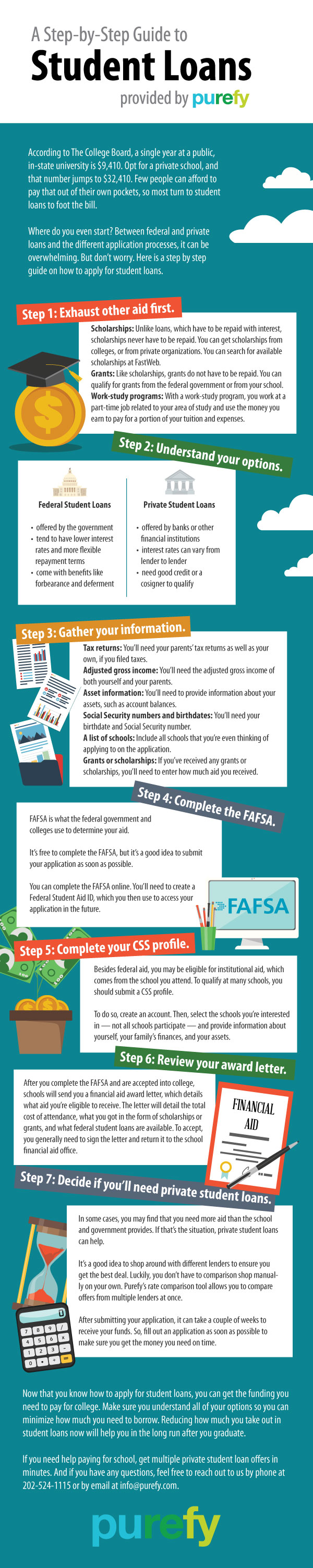

There are three main types of federal student aid: grants, loans, and work-study programs. These forms of aid are intended to make higher education more affordable for students who may not otherwise be able to afford it.

Grants

Grants are considered “free money” as they do not have to be repaid. They are typically need-based, meaning they are awarded based on a student’s financial need. The two most common grants are the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG).

Pell Grant

The Pell Grant is the largest source of federal grant aid for undergraduate students with exceptional financial need. It is awarded to students who have not yet earned a bachelor’s or professional degree. The amount of the Pell Grant varies based on financial need, cost of attendance, and enrollment status.

To be eligible for the Pell Grant, students must meet certain requirements such as being a U.S. citizen or eligible non-citizen, having a high school diploma or GED, and being accepted into an eligible program at a participating institution.

FSEOG

The FSEOG is a grant awarded to undergraduate students with exceptional financial need. Unlike the Pell Grant, the FSEOG is distributed by individual schools rather than directly from the federal government. This means that funds are limited and not all eligible students may receive the grant.

To be considered for the FSEOG, students must complete the Free Application for Federal Student Aid (FAFSA) and demonstrate exceptional financial need.

Loans

Unlike grants, loans must be repaid with interest. However, they often have lower interest rates than private loans and may offer more flexible repayment options. There are two types of federal student loans: Direct Subsidized Loans and Direct Unsubsidized Loans.

Direct Subsidized Loans

Direct Subsidized Loans are available to undergraduate students with demonstrated financial need. Interest on these loans is paid by the government while the student is enrolled at least half-time, during a six-month grace period after graduation, and during periods of deferment.

To be eligible for a Direct Subsidized Loan, students must meet the same criteria as those for the Pell Grant and FSEOG.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are available to both undergraduate and graduate students regardless of financial need. Unlike subsidized loans, interest on unsubsidized loans accrues while the student is in school. It is recommended that students pay at least the interest while in school to avoid having it added to the total loan amount.

Work-Study Programs

The Federal Work-Study Program provides part-time jobs for undergraduate and graduate students who demonstrate financial need. These jobs can be on or off campus and typically involve community service or work related to the student’s field of study. The program encourages students to work up to 20 hours per week while in school to help cover expenses.

To be eligible for the Federal Work-Study Program, students must meet the same requirements as those for the Pell Grant and FSEOG.

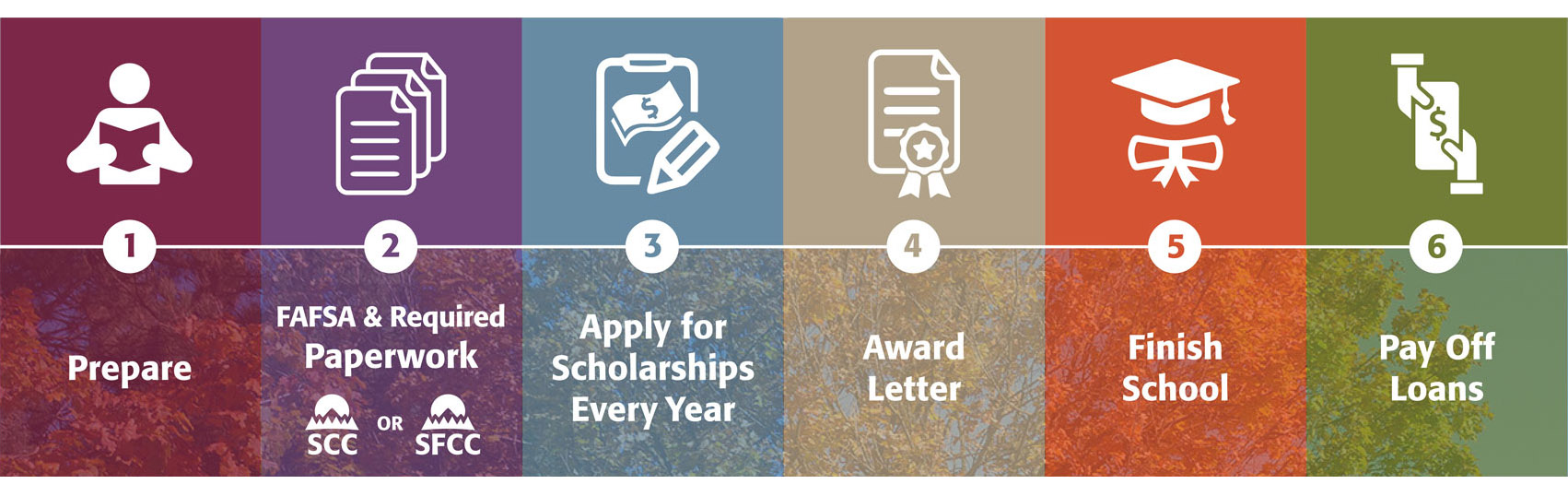

Applying for Federal Student Aid

To apply for federal student aid, students must fill out the FAFSA. This form collects information about the student’s financial situation to determine their eligibility for different types of aid. The FAFSA opens every year on October 1st and should be completed as soon as possible to maximize chances of receiving aid.

Step 1: Gather Necessary Information

Before filling out the FAFSA, students should gather all necessary information such as their Social Security Number, federal income tax returns, W-2 forms, bank statements, and records of investments or untaxed income.

Step 2: Create an FSA ID

An FSA ID is a username and password that allows students to sign the FAFSA electronically. Both the student and one parent (if dependent) need to create an FSA ID before filling out the FAFSA.

Step 3: Fill Out the FAFSA

The FAFSA can be filled out online at fafsa.gov. It typically takes about 30 minutes to complete and must be signed by both the student and one parent (if dependent). The FAFSA will ask questions about the student’s personal information, financial situation, and school preferences.

Step 4: Review and Submit

After completing the FAFSA, it is important to review all information for accuracy before submitting. Any errors or missing information could delay the application process. Once submitted, the FAFSA will be processed and the student will receive a Student Aid Report (SAR) summarizing their eligibility for federal student aid.

Frequently Asked Questions

What is the maximum amount of Pell Grant a student can receive?

For the 2020-2021 academic year, the maximum amount of Pell Grant a student can receive is $6,345. This amount may change each year depending on factors such as changes in the cost of attendance and available funding.

Can international students apply for federal student aid?

No, federal student aid is only available to U.S. citizens or eligible non-citizens. However, international students may be eligible for other forms of financial aid provided by their school or private organizations.

Do I have to pay back work-study earnings?

No, work-study earnings are considered regular wages and do not have to be repaid. Students can use their earnings to cover expenses such as tuition, fees, and living expenses.

Can graduate students receive the Pell Grant?

No, only undergraduate students are eligible for the Pell Grant. Graduate students may be eligible for other forms of federal student aid such as Direct Unsubsidized Loans.

Do I need to reapply for federal student aid every year?

Yes, students must complete the FAFSA every year they wish to receive federal student aid. Financial situations may change from year to year, so it is important to update the FAFSA with current information each year.

Conclusion

Federal student aid is an essential resource for students pursuing higher education. With various types of aid available and a relatively simple application process, it is a great option for those in need of financial assistance. By understanding the different types of aid, eligibility requirements, and how to apply, students can make their educational dreams a reality without worrying about the costs.