Financial reporting standards are a set of guidelines and rules that govern the preparation and presentation of financial statements. These standards ensure consistency, transparency, and comparability in financial reporting, which is crucial for investors, creditors, and other stakeholders to make informed decisions. In this article, we will delve deeper into the world of financial reporting standards and understand its importance.

DANH MỤC BÀI VIẾT

The History and Development of Financial Reporting Standards

The concept of financial reporting standards can be traced back to the early 20th century when the first set of accounting principles, known as the Generally Accepted Accounting Principles (GAAP), was established in the United States. However, it wasn’t until the 1970s that international efforts were made to harmonize accounting standards globally. This led to the formation of the International Accounting Standards Committee (IASC) in 1973, which later became the International Accounting Standards Board (IASB) in 2001.

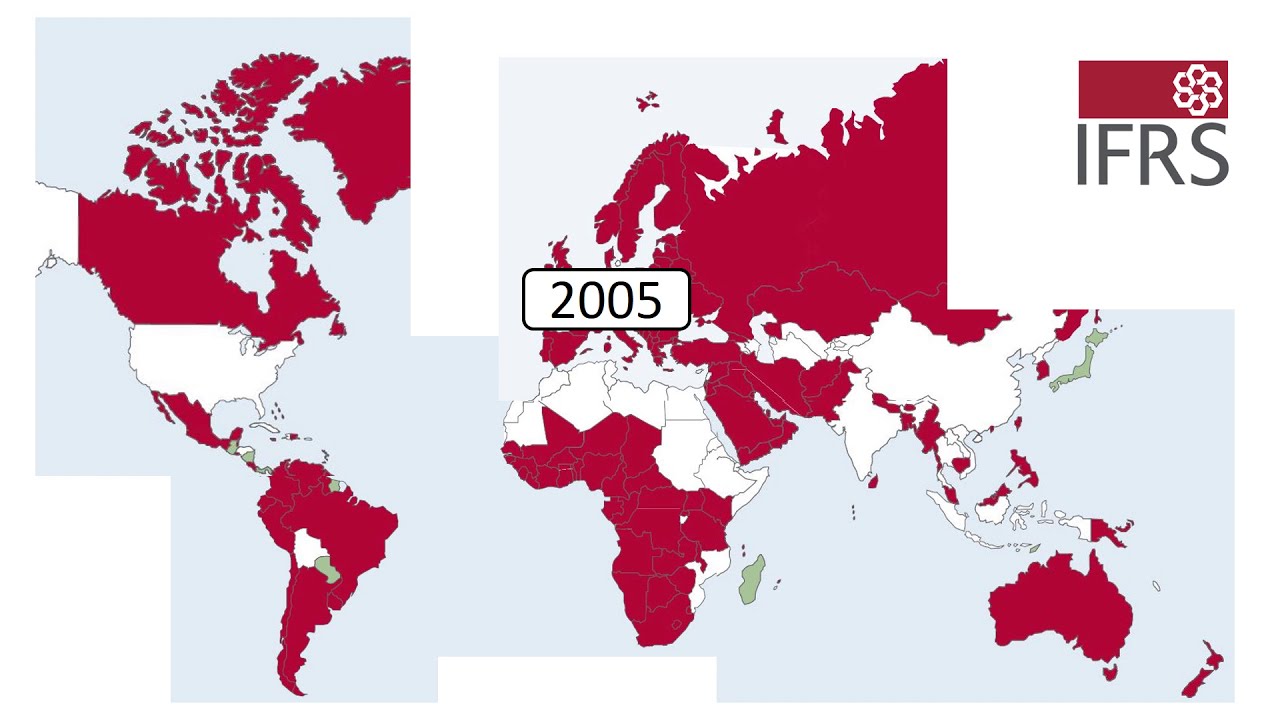

Currently, the two most widely used sets of financial reporting standards are the GAAP, followed primarily in the United States, and the International Financial Reporting Standards (IFRS), adopted by more than 140 countries. While both these standards have their unique features, they aim to achieve the same objective – to provide high-quality financial information to users.

The Role of Regulators in Setting Financial Reporting Standards

Regulatory bodies play a crucial role in setting and enforcing financial reporting standards. In the United States, the Securities and Exchange Commission (SEC) is responsible for regulating financial reporting for publicly traded companies. It requires these companies to adhere to the GAAP guidelines in preparing their financial statements. On the other hand, the IASB, an independent standard-setting body, develops and issues the IFRS, which is then adopted by individual countries’ respective accounting regulators.

In addition to these regulatory bodies, organizations such as the Financial Accounting Standards Board (FASB) and the International Federation of Accountants (IFAC) also contribute to the development and implementation of financial reporting standards.

Understanding the Importance of Financial Reporting Standards

Financial reporting standards play a vital role in ensuring the accuracy, transparency, and comparability of financial information. Let’s take a closer look at some of the key reasons why these standards are essential for businesses and stakeholders.

Facilitates Decision Making

Accurate and reliable financial information is crucial for investors, creditors, and other stakeholders to make informed decisions about an organization. Financial reporting standards help achieve this by providing a framework for preparing financial statements that are consistent and comparable across companies, industries, and countries. This allows users to analyze and compare financial information from different organizations, aiding them in making better investment or lending decisions.

Promotes Transparency and Accountability

Financial reporting standards require companies to disclose all material information that may impact their financial position, performance, and prospects. This promotes transparency, which helps build trust and confidence among stakeholders. It also holds companies accountable for their financial actions and helps prevent fraudulent activities.

Boosts Investor Confidence

Consistent and transparent financial reporting enhances investor confidence in a company. When a company follows financial reporting standards, it shows its commitment to providing accurate and reliable financial information to its stakeholders. This, in turn, improves investor confidence, leading to increased investor participation and interest in the company.

The Key Principles of Financial Reporting Standards

Financial reporting standards are based on a few fundamental principles that guide the preparation and presentation of financial statements. These principles provide a basis for the development of specific accounting standards that address various accounting aspects. Let’s explore the four main principles of financial reporting standards:

Relevance

Relevance refers to the ability of financial information to influence the decisions of users. To be relevant, financial information must be timely, have predictive value, and confirmatory value. Timeliness ensures that the information is available when needed, predictive value helps users make future predictions, and confirmatory value validates or confirms the information presented.

Reliability

Reliability refers to the quality of financial information that makes it free from material errors or bias. To be reliable, financial information must be complete, accurate, and neutral. Completeness implies that all necessary information is included in the financial statements, accuracy ensures that the information is error-free, and neutrality means that the information is unbiased and free from any management influence.

Comparability

Comparability refers to the ability to compare financial information between different companies, industries, or countries. Financial reporting standards aim to achieve comparability by providing a uniform framework for preparing financial statements. This allows users to analyze and compare financial information from different sources to make informed decisions.

Understandability

Understandability refers to the ease with which financial information can be comprehended by its users. Financial reporting standards require companies to present financial information in a clear and concise manner, using simple and understandable language and formats. This ensures that even non-accountants can understand and interpret the information presented.

FAQs about Financial Reporting Standards

What are the main differences between GAAP and IFRS?

The main difference between GAAP and IFRS lies in their approach towards accounting principles. While GAAP follows a rule-based approach, where specific rules and guidelines must be followed, IFRS adopts a principles-based approach, allowing for more judgment and interpretation in financial reporting.

Who sets financial reporting standards in the United States?

In the United States, financial reporting standards are primarily set by the Financial Accounting Standards Board (FASB) and enforced by the Securities and Exchange Commission (SEC).

Can small businesses use financial reporting standards?

Yes, small businesses can also use financial reporting standards to prepare their financial statements. However, they may have some exemptions or simplified versions of the standards available to them.

Are financial reporting standards mandatory for all organizations?

In most countries, financial reporting standards are mandatory for publicly traded companies. However, some private companies may also be required to follow these standards based on their size, industry, or regulatory requirements.

How often are financial reporting standards updated?

Financial reporting standards are regularly reviewed and updated by the respective standard-setting bodies. For example, the IASB issues updates and amendments annually, while the FASB publishes new accounting standards periodically.

Conclusion

Financial reporting standards are an essential aspect of the accounting profession. They ensure consistency, transparency, and comparability in financial reporting, facilitating better decision-making and promoting trust among stakeholders. While different countries may have their unique standards, the underlying principles remain the same – to provide high-quality financial information to users. As the business landscape continues to evolve, it is crucial for organizations to stay updated with the latest financial reporting standards to maintain their credibility and meet the needs of their stakeholders.