A cash flow statement is an essential financial document that provides insight into the inflow and outflow of cash in a business. It tracks the movement of cash within a specific period, usually monthly, quarterly, or annually. It is crucial for businesses to understand their cash flow as it impacts their financial stability and growth. In this article, we will delve into the details of a cash flow statement, its components, and why it is vital for businesses.

DANH MỤC BÀI VIẾT

What is a Cash Flow Statement?

A cash flow statement is a financial report that outlines the cash inflows and outflows of a business. It shows how much cash is coming into the company from operating activities, investing activities, and financing activities. The purpose of a cash flow statement is to help businesses track their liquidity and ensure they have enough cash on hand to meet their financial obligations.

Components of a Cash Flow Statement

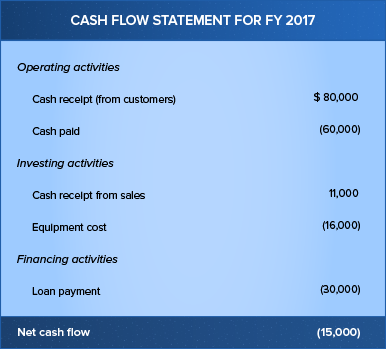

A cash flow statement typically consists of three main sections: operating activities, investing activities, and financing activities. Let’s take a closer look at each section and what it entails.

Operating Activities

The operating activities section of a cash flow statement shows the cash flow resulting from the day-to-day operations of the business. It includes cash received from customers and payments made to suppliers, employees, and other operating expenses. This section indicates whether the business is generating enough cash from its core operations to sustain its daily activities.

Investing Activities

The investing activities section of a cash flow statement shows the cash flow related to investments in long-term assets, such as property, equipment, and investments in other companies. It includes cash received from the sale of assets and cash used to purchase new assets. This section gives insight into the capital expenditures of the business and its investment decisions.

Financing Activities

The financing activities section of a cash flow statement shows the cash flow resulting from the financing of the business, such as issuing stock, taking out loans, or paying dividends. It includes cash received from investors or lenders and cash paid to shareholders or creditors. This section reveals how the business is funding its operations and whether it is generating enough cash to pay off its debts.

How to Prepare a Cash Flow Statement

Preparing a cash flow statement can seem daunting, but it’s crucial for businesses to have an accurate understanding of their cash flow. Here are the essential steps to follow when creating a cash flow statement:

Step 1: Gather Financial Records

The first step in preparing a cash flow statement is to gather all the necessary financial records. These include income statements, balance sheets, and any other documents that show the inflow and outflow of cash.

Step 2: Determine Cash Inflows

The next step is to determine the cash inflows from operating activities, investing activities, and financing activities. This involves adding up cash receipts from customers, the sale of assets, and cash received from investors or lenders.

Step 3: Determine Cash Outflows

After determining the cash inflows, the next step is to determine the cash outflows for each activity. This includes calculating payments to suppliers, employees, and creditors, as well as any investments or financing expenses.

Step 4: Calculate Net Cash Flow

Once you have determined the cash inflows and outflows for each activity, the next step is to calculate the net cash flow by subtracting the total cash outflow from the total cash inflow.

Step 5: Create a Cash Flow Statement

Using the information gathered from the previous steps, create a cash flow statement that outlines the cash inflows and outflows for the specified period.

Importance of a Cash Flow Statement

A cash flow statement is crucial for businesses for several reasons. Let’s take a look at some of the key reasons why businesses should pay attention to their cash flow statement.

Ensures Liquidity

A cash flow statement helps businesses keep track of their liquidity, or how much cash they have on hand. It allows businesses to identify potential cash shortages and take the necessary steps to address them before they become a problem.

Helps with Financial Planning

A cash flow statement provides insight into the financial health of a business and helps with financial planning. It allows businesses to identify areas where they can cut costs or increase revenue, making it an essential tool for financial management.

Assists with Decision Making

A cash flow statement is an excellent resource for decision-making. It helps businesses determine whether they have enough cash to invest in new projects or if they need to seek additional funding. It also helps with evaluating the success of past decisions and their impact on cash flow.

FAQs about Cash Flow Statements

1. What is the difference between a cash flow statement and an income statement?

While both documents are used to assess the financial health of a business, they serve different purposes. A cash flow statement shows the actual movement of cash in and out of the business, while an income statement reflects the company’s profitability over a specified period.

2. How often should a cash flow statement be prepared?

A cash flow statement should be prepared at least quarterly, but many businesses opt to prepare it monthly to keep a closer eye on their cash flow.

3. Is a positive cash flow always a good thing?

Not necessarily. While positive cash flow indicates that the business has enough cash on hand to meet its financial obligations, it could also mean that the company is not investing enough in its growth.

4. Can a business have negative cash flow and still be profitable?

Yes, a business can have negative cash flow and still be profitable. This may occur when a company is investing heavily in its growth, which requires significant upfront costs but will generate profits in the future.

5. Who uses cash flow statements?

Cash flow statements are used by businesses of all sizes and industries, as well as investors, creditors, and other stakeholders to gain insight into the financial health of a company.

Conclusion

A cash flow statement is an essential financial document for businesses as it helps track cash inflows and outflows, ensuring liquidity, aiding in financial planning, and assisting with decision-making. By understanding the components of a cash flow statement and how to prepare one, businesses can gain a better understanding of their financial health and make informed decisions for their future growth and success.